We post news and comment on federal criminal justice issues, focused primarily on trial and post-conviction matters, legislative initiatives, and sentencing issues.

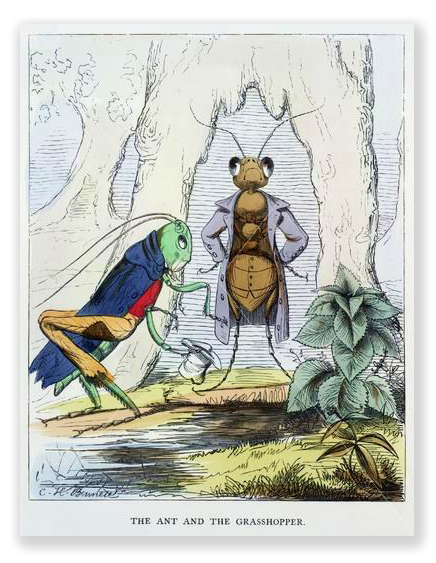

THE ANT AND THE GRASSHOPPER

Most kids recall Aesop’s fable about the grasshopper who played away the summer while his neighbor, the industrious ant, worked dawn to dusk storing food for the winter. You can imagine the ending: the grasshopper. When the cold winds blow, the hungry grasshopper begs for food from the ant but is refused.

Most kids recall Aesop’s fable about the grasshopper who played away the summer while his neighbor, the industrious ant, worked dawn to dusk storing food for the winter. You can imagine the ending: the grasshopper. When the cold winds blow, the hungry grasshopper begs for food from the ant but is refused.

The situation sums up the virtues of hard work and planning for the future, a lesson lost on the Federal Bureau of Prisons when it came to wisely using the years following the First Step Act’s passage to expand access to halfway house space.

Admittedly, 18 USC § 3624(g) is a long, convoluted subsection. But that’s no excuse for the BOP skipping the very last paragraph, which says “[t]he Director of the Bureau of Prisons shall ensure there is sufficient prerelease custody capacity to accommodate all eligible prisoners.” After all, “shall” means “shall” and “all” means “all.”

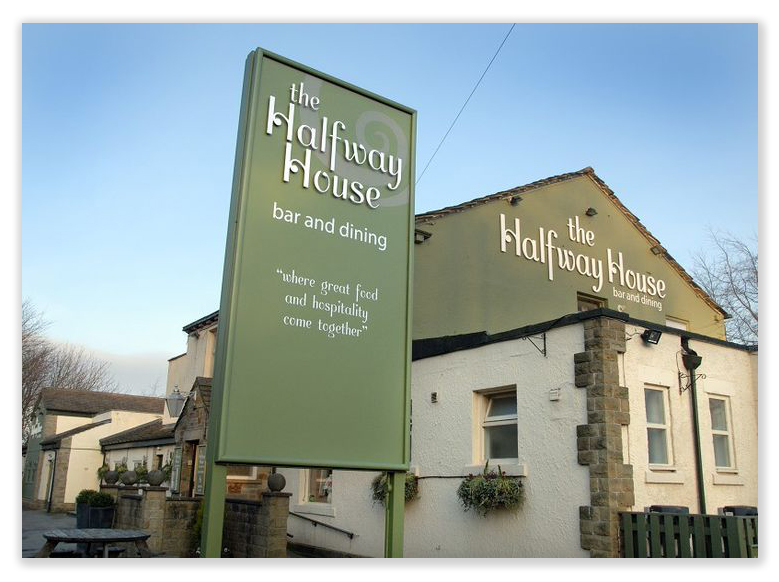

The grasshopper was reduced to begging. The BOP, on the other hand, has addressed its lack of preparation by vigorously arguing that nothing was its fault and that inmates with FSA credits earned by successfully completing programming that reduces recidivism can use them for halfway house or home confinement only at the whim of the halfway houses. The BOP has told courts that a prisoner has no constitutional right to be placed in a particular facility and that the BOP has exclusive authority and discretion to designate the place of confinement.

The shortage of halfway house or home confinement capacity for all of the FTCs people have to redeem is no secret. BOP Director Collette Peters testified about it before Congress last summer. Her lament that the BOP has a “capacity” problem – like the government’s use of the shortage as a reason FTCs cannot be redeemed – has a flavor of John Belushi as Jake Blue, kneeling in the muck in front of Carrie Fisher, blubbering that his tux had been at the cleaners and that “it’s not my fault.”

What has been a secret, however, is that the BOP apparently has been fully aware that “shall” means “shall,” and that it is obligated to place prisoners in halfway house or home confinement when their FTCs dictate, not when the halfway house says so. In a remarkable article published this week in ExpertClick, former BOP official and consultant Bruce Cameron and recently retired BOP Unit Management Section Chief Susan M. Giddings – candidly acknowledge that “[t]he BOP has no discretion to deny or delay transfer to prerelease custody for any reason, including the lack of physical space.”

What has been a secret, however, is that the BOP apparently has been fully aware that “shall” means “shall,” and that it is obligated to place prisoners in halfway house or home confinement when their FTCs dictate, not when the halfway house says so. In a remarkable article published this week in ExpertClick, former BOP official and consultant Bruce Cameron and recently retired BOP Unit Management Section Chief Susan M. Giddings – candidly acknowledge that “[t]he BOP has no discretion to deny or delay transfer to prerelease custody for any reason, including the lack of physical space.”

It is not surprising that Bruce would state this obvious fact. He retired from the BOP 11 years ago and has run Federal Prison Authority, a consultancy that (among other things) assists people with RDAP and placement in community programs ever since. But Dr. Giddings – whose declarations have supported any number of government oppositions to prisoner habeas petitions since First Step – only retired from the BOP five months ago. As the “go-to” BOP official on all matters related to FTCs, she would have been privy to the BOP’s thinking when she retired in the same month as the remarkable Woodley v. Warden decision was handed down by a district court in Kansas.

In the ExpertClick article, Susan and Bruce argue that the Woodley decision has limits that are easily overlooked. The Woodley court ruled that while the BOP must place an inmate so that she may use all of her FTCs, the agency “retains its discretion regarding the type and location of placement.” They focus on the Woodley court’s caveat that “the BOP retains the discretion to decide whether to transfer the petitioner to a [halfway house] or home confinement, or even whether to transfer to petitioner to early supervised release[…] Nor does the Court require that petitioner be placed in any particular [halfway house]; thus, the BOP retains the discretion to choose the particular prerelease facility.”

Petitioner Woodley could not be placed in a Tampa halfway house in time to use his FTCs, so pursuant to the court’s order that it do something to place him, the BOP sent him to one in Orlando, 70 miles away. Susan and Bruce complain that by requiring placement so as to use all of a prisoner’s FTCs,

Congress gutted the real and vital purpose of reentry services. Yet, that is the real issue and impact of Woodley. For all their talk, Congress failed to include participation in a meaningful prerelease community program as a part of the FSA, literally contradicting the purpose of the Second Chance Act. So, whether an incarcerated person is placed 5, 50, or 500 miles from their home and community, all that matters is that they were transferred.

It is unlikely that an inmate seeking to cash in his FTCs cares much about the meaningfulness of the “prerelease community program” to which he is sent. What is noteworthy to prisoners is that experts – especially Dr. Giddings, only months from having been at the center of BOP decision-making on all matters related to FTCs – accept as a given Woodley’s holding that “[t]he BOP has no discretion to deny or delay transfer to prerelease custody for any reason, including the lack of physical space.”

It is unlikely that an inmate seeking to cash in his FTCs cares much about the meaningfulness of the “prerelease community program” to which he is sent. What is noteworthy to prisoners is that experts – especially Dr. Giddings, only months from having been at the center of BOP decision-making on all matters related to FTCs – accept as a given Woodley’s holding that “[t]he BOP has no discretion to deny or delay transfer to prerelease custody for any reason, including the lack of physical space.”

Woodley v. Warden, Case No. 24-3053, 2024 USDist LEXIS 87521 (D.Kan. May 15, 2024)

ExpertClick, Woodley v. Warden Revisited: Time Credits, Prerelease Placement, and Agency Discretion (October 17, 2024)

House Subcommittee on Crime And Government Surveillance, Testimony of Colette Peters (July 23, 2024)

– Thomas L. Root

The BOP probably doesn’t like that big white bear, the fact that it is required to deliver on RRC placement despite the agency’s utter failure over five years to ensure that there was enough RRC space. But as Dostoevsky or Tolstoy (or both) figured out, just because you can force yourself to not think about it doesn’t mean it isn’t there.

The BOP probably doesn’t like that big white bear, the fact that it is required to deliver on RRC placement despite the agency’s utter failure over five years to ensure that there was enough RRC space. But as Dostoevsky or Tolstoy (or both) figured out, just because you can force yourself to not think about it doesn’t mean it isn’t there.