We post news and comment on federal criminal justice issues, focused primarily on trial and post-conviction matters, legislative initiatives, and sentencing issues.

IT’S ALL ABOUT THE BENJAMINS

The House of Representatives finally released the text of the new stimulus package last Thursday, the 591-page American Rescue Plan, which includes billions of dollars for vaccine, unemployment benefits, state coffers, small businesses and stimulus checks, not to mention a grab-bag of special interest goodies like $15.00 an hour for the kid assembling sandwiches at the neighborhood McDonalds.

The House of Representatives finally released the text of the new stimulus package last Thursday, the 591-page American Rescue Plan, which includes billions of dollars for vaccine, unemployment benefits, state coffers, small businesses and stimulus checks, not to mention a grab-bag of special interest goodies like $15.00 an hour for the kid assembling sandwiches at the neighborhood McDonalds.

The American Rescue Plan contains something for almost everyone. Almost. For federal prisoners, the bad news is this: unlike the CARES Act (adopted 11 months ago) and the HEROES Act (a House measure last May that never passed the Senate), the American Rescue Plan contains nothing easing compassionate release, fixing the elderly offender home detention plan, or addressing any other criminal justice program.

The good news: inmates will be eligible for the $1,400 stimulus payment, just as they were eligible for the prior $1,200 and $600 payments.

[How to get stimulus payments, old and new]

The reasons that the ARP left out in a criminal justice measures are complex. Primarily, it is because Congress wanted to move rapidly, and the Democrats are pushing hard for Republican support in the evenly divided Senate. The New York Times reports that the House may pass the ARP this week, and the goal is to have President Biden sign the bill by March 14 (when existing federal unemployment money runs out). ARP is all about money, and sponsors want to keep it that way, because as a money bill, ARP has broad public support.

The Biden administration clearly plans some sort of comprehensive criminal justice reform this year. At a townhall meeting in Milwaukee last week, Biden said, “No one should go to jail for the use of a drug. They should go to drug rehabilitation.” The sentencing system should be changed to one that focuses on making sure that there are rehabilitation plans for inmates more generally, Biden said, adding that prison systems should have access to vocational programs that help those behind bars learn the career skills they need to succeed outside of prison.”

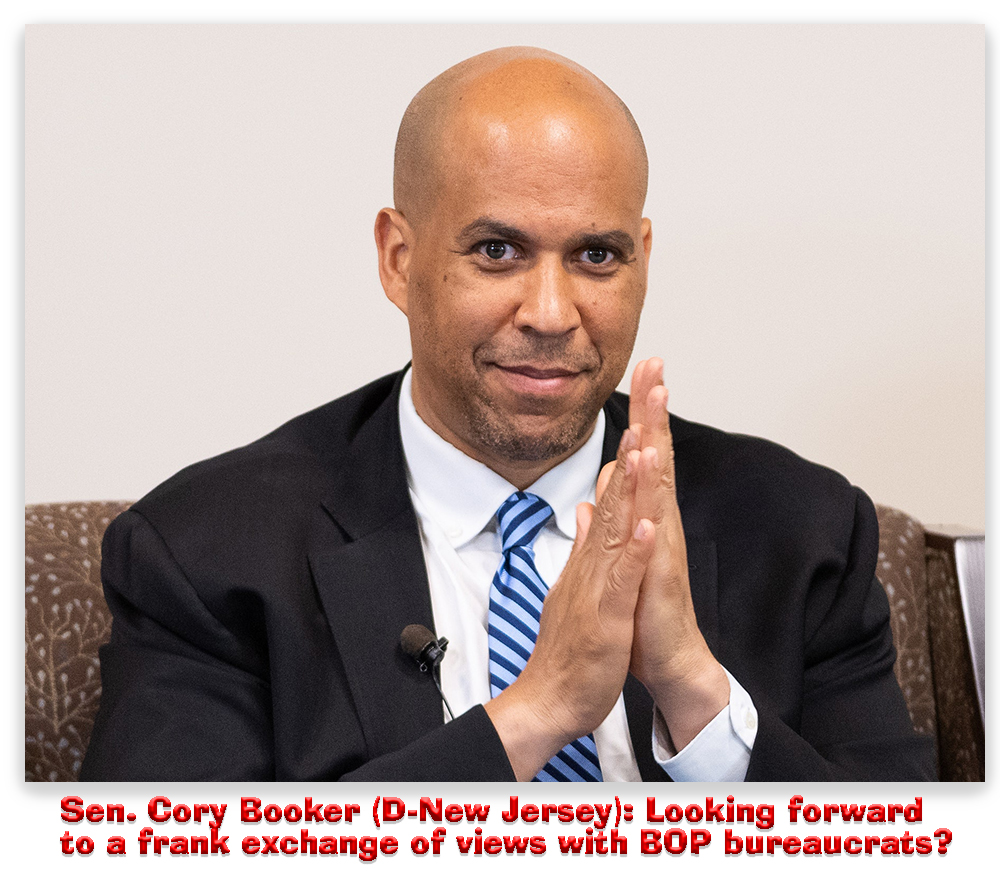

Meanwhile, Sen. Cory Booker (D-New Jersey) has been picked to chair the Senate Judiciary Committee’s Subcommittee on Criminal Justice and Counterterrorism. The subcommittee’s jurisdiction includes the Dept of Justice Criminal Division; the Drug Enforcement Administration, Bureau of Prisons, Sentencing Commission, and other law enforcement agencies.

Meanwhile, Sen. Cory Booker (D-New Jersey) has been picked to chair the Senate Judiciary Committee’s Subcommittee on Criminal Justice and Counterterrorism. The subcommittee’s jurisdiction includes the Dept of Justice Criminal Division; the Drug Enforcement Administration, Bureau of Prisons, Sentencing Commission, and other law enforcement agencies.

This is significant, because a subcommittee chairman controls the subcommittee’s agenda, and can bring substantial pressure – even without writing legislation – on the agencies it oversees. “Our nation’s broken criminal justice system is a stain on the soul of our country, the result of decades of failed policies that have broken apart families and communities and have not made us safer,” Booker said. “I look forward to continuing and strengthening my partnership with Chairman Durbin [Sen Richard Durbin (D-Illinois), chair of the Senate Judiciary Committee] to further advance reforms to our policing and criminal justice system.”

Finally, interest groups finally have sympathetic ears in Congress and at DOJ. In an open letter to the not-yet-confirmed Attorney General, Merrick Garland, the ACLU urged him “to make clear, on-the-record commitments on five critical issues: mass incarceration; policing; COVID-19 in federal detention; the death penalty; and solitary confinement.” The ACLU asked that the “Trump DOJ’s efforts to thwart Congressional intent behind the FIRST STEP Act of 2018 should also be reversed: DOJ should support application of the Act’s reduced penalties at all sentencings, including resentencings in cases where an illegal sentence was vacated.”

Finally, interest groups finally have sympathetic ears in Congress and at DOJ. In an open letter to the not-yet-confirmed Attorney General, Merrick Garland, the ACLU urged him “to make clear, on-the-record commitments on five critical issues: mass incarceration; policing; COVID-19 in federal detention; the death penalty; and solitary confinement.” The ACLU asked that the “Trump DOJ’s efforts to thwart Congressional intent behind the FIRST STEP Act of 2018 should also be reversed: DOJ should support application of the Act’s reduced penalties at all sentencings, including resentencings in cases where an illegal sentence was vacated.”

HR -____, American Rescue Plan (reported to the House), Feb 18, 2021

New York Times, Republicans Struggle to Derail Increasingly Popular Stimulus Package (February 19, 2021)

Washington Examiner, Biden: ‘No one should go to jail for the use of a drug’ (February 16, 2021)

NJInsider, Booker to Chair Senate Judiciary Subcommittee on Criminal Justice and Counterterrorism (February 14, 2021)

ACLU, Open Letter to Merrick Garland (February 18, 2021)

– Thomas L. Root