We post news and comment on federal criminal justice issues, focused primarily on trial and post-conviction matters, legislative initiatives, and sentencing issues.

This weekend marks the end of summer, maybe not astronomically or meteorologically, but Monday the Supreme Court begins its next term, called “October Term 2023.” Fall is here, but first, we’re going to end the summer with a short rocket:

This weekend marks the end of summer, maybe not astronomically or meteorologically, but Monday the Supreme Court begins its next term, called “October Term 2023.” Fall is here, but first, we’re going to end the summer with a short rocket:

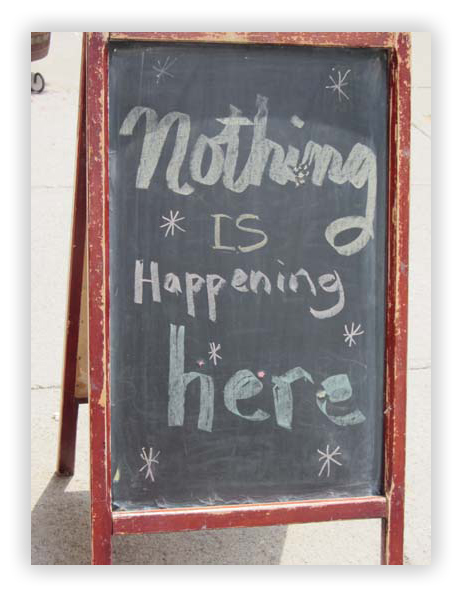

DOES NOT COMPUTE

The BOP announced in late 2022 that it was developing a calculator to project the maximum number of earned-time credits – now being called FSA credits – a prisoner could earn at the outset of a sentence. That way, a prisoner would know upfront his or her projected release date and the date that halfway house or home confinement could begin.

You may have been skeptical, recalling that in 2022, the BOP promised monthly auto-calculation of FSA credits (with more launch dates than North Korea’s missile program) that never happened, either. August became September became October, then November, and finally January. Writing in Forbes magazine last week, Walter Pavlo reported that the BOP has likewise been unable to determine likely dates for prerelease custody, depriving inmates of benefits of FSA credits to which they are entitled by law because the BOP is unable to scramble to arrange halfway house or get residence approval for home confinement.

You may have been skeptical, recalling that in 2022, the BOP promised monthly auto-calculation of FSA credits (with more launch dates than North Korea’s missile program) that never happened, either. August became September became October, then November, and finally January. Writing in Forbes magazine last week, Walter Pavlo reported that the BOP has likewise been unable to determine likely dates for prerelease custody, depriving inmates of benefits of FSA credits to which they are entitled by law because the BOP is unable to scramble to arrange halfway house or get residence approval for home confinement.

What’s worse, Pavlo reported, “there is no date for when this calculation issue will be addressed. Until then, prisoners continue to line up outside of their case manager’s office to plead their case that their release date is closer than what the BOP is calculating. As one prisoner told me, ‘My case manager said, ‘the computer tells your release date and it could be tomorrow, or next week, or next year, it does not matter to me. But I don’t have the ability to make that decision myself’.”

The BOP Office of Public Affairs told Pavlo that “credits cannot be applied to an individual’s projected release date until they are actually ‘earned.’ Further, as an individual can earn 15 days of time credits, and as there is no partial or prorated credit, it is feasible that earned credits could be greater than the number of days remaining to serve. However, the earned time credits are ‘in an amount that is equal to the remainder of the prisoner’s imposed term of imprisonment.’ Simply stated,” Pavlo said, “the credits are earned, and they cannot exceed the remaining time to serve at the point they are earned.”

The BOP’s position, according to Pavlo, is that “ordinarily, the applicability of time credits towards pre-release custody will be limited to time credits earned as of the date of the request for community placement. However, in an effort to ensure eligible adults in custody receive the maximum benefit, the agency is developing additional auto-calculation applications that will calculate a “Conditional FSA Release Date” and an “Earliest Conditional Pre-Release Date” which would include the maximum FTC benefit.”

The BOP’s position, according to Pavlo, is that “ordinarily, the applicability of time credits towards pre-release custody will be limited to time credits earned as of the date of the request for community placement. However, in an effort to ensure eligible adults in custody receive the maximum benefit, the agency is developing additional auto-calculation applications that will calculate a “Conditional FSA Release Date” and an “Earliest Conditional Pre-Release Date” which would include the maximum FTC benefit.”

Basically, the BOP is still trying to figure out how to implement a First Step program it knew about 5 years ago.

Forbes, Bureau of Prisons’ Challenges With First Step Act Release Dates (September 17, 2023)

SCHUMER MAY ADD CRIMINAL JUSTICE PROVISIONS TO NEWLY-REFERRED MARIJUANA BILL

Fresh from getting the Senate Senate Majority Leader Charles Schumer (D-NY) indicated yesterday that he may attach criminal justice reform language to the cannabis banking bill that just passed the Senate Banking Committee on Wednesday.

Speaking on the Senate floor, he said he was “really proud of the bipartisan deal we produced,” a reference to the Secure and Fair Enforcement Regulation Banking (SAFER) Act, S.1323. And while the legislation will be brought to a full Senate vote “soon,” Schumer promised to include “very significant criminal justice provisions” in it, Marijuana Moment reported.

Schumer didn’t say what those reforms might be noting he would “talk more about that at a later time.”

“Attaching any additional provisions – let alone ones on criminal justice — could imperil SAFER‘s chances of winning Senate approval, according to the finance website Seeking Alpha. “Prior attempts to add criminal justice language into marijuana-related legislation has led to controversy.”

“Attaching any additional provisions – let alone ones on criminal justice — could imperil SAFER‘s chances of winning Senate approval, according to the finance website Seeking Alpha. “Prior attempts to add criminal justice language into marijuana-related legislation has led to controversy.”

In May, Schumer said a marijuana banking bill would have social justice reforms and criminal expungement language attached. And in 2022, Sen. Cory Booker (D-NJ) said he would favor a “SAFE Banking Plus” bill that includes criminal justice reforms.

Marijuana Moment, Schumer Touts Bipartisan ‘Momentum’ Behind Marijuana Banking Bill That He Plans To Bring To The Floor ‘Soon’ With More ‘Criminal Justice Provisions’ (September 28, 2023)

Seeking Alpha, Schumer indicates he may tie in criminal justice to marijuana banking bill (September 28, 2023)

$117 A DAY WON’T BUY YOU PERFORMANCE

Maybe that’s all the performance you can expect for $117 a day. That’s what the BOP said last week is the current average cost of incarceration based on fiscal year 2022 data. The average annual COIF for a Federal inmate housed in a halfway house for FY 2022 was $39,197 ($107.39 per day).

BOP, Annual Determination of Average Cost of Incarceration Fee (COIF), 88 FR 65405 (September 22, 2023)

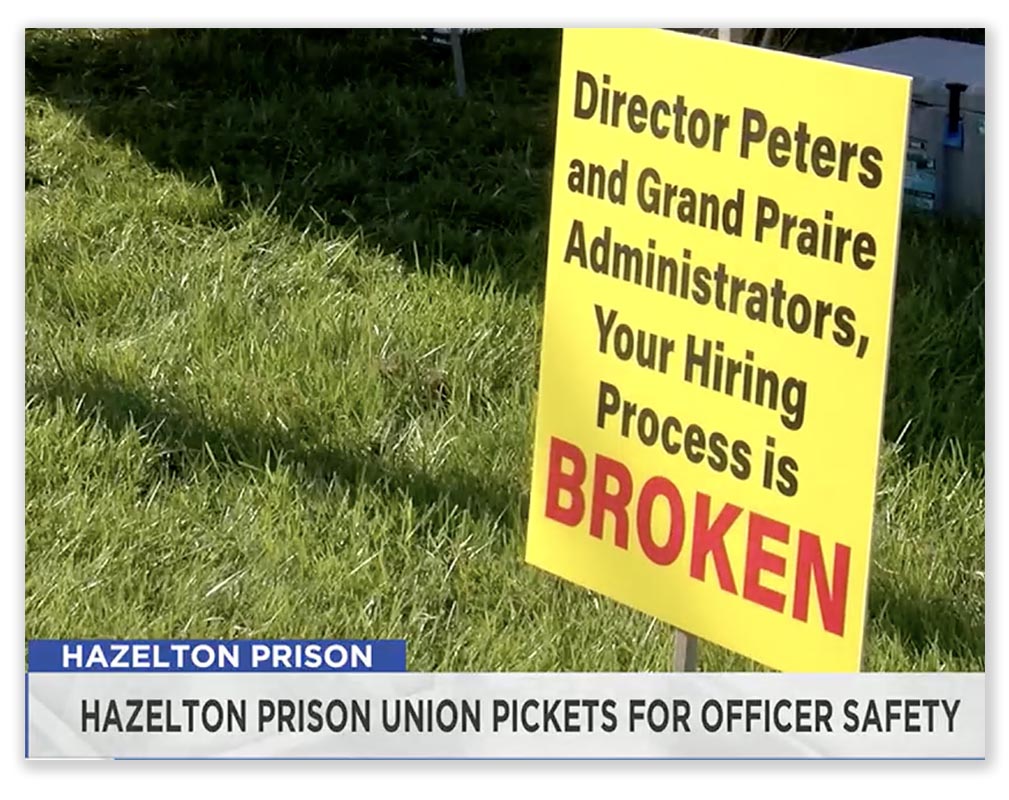

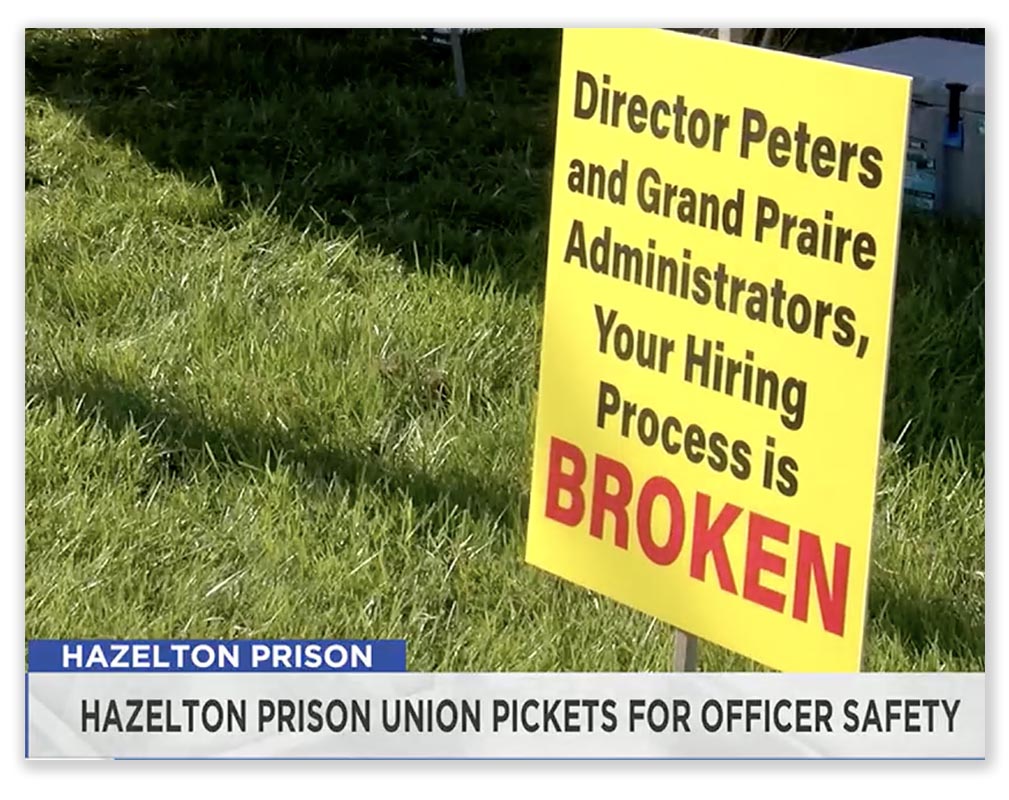

HAZELTON BOP UNION SAYS EMPLOYMENT STANDARDS HOBBLE STAFFING AS SHUTDOWN LOOMS

Picket signs waved all day long last Friday as members of the FCC Hazelton local 420 union representing the prison say the staffing shortage has gotten so bad officers have to work 16-hour shifts 4 to 5 days a week, with stringent employment standards partly to blame.

Union President Justin Tarovisky says the prison is currently short-staffed by more than 80 corrections officers. He complained that the union held a recruiting event where they took in 60 applicants, but the BOP office in Grand Prairie, Texas, that oversees these applications has been disqualifying applicants for superficial reasons.

“A lot of that common sense hiring has left this agency,” Tarovisky told WDTV, a Weston, WV, television station. “They’re handcuffing these applicants that are applying and disqualifying them for simple errors and it’s not our staff that’s disqualifying them, we can’t even get them in the door to interview them because they’re being disqualified by people halfway across the country.”

“A lot of that common sense hiring has left this agency,” Tarovisky told WDTV, a Weston, WV, television station. “They’re handcuffing these applicants that are applying and disqualifying them for simple errors and it’s not our staff that’s disqualifying them, we can’t even get them in the door to interview them because they’re being disqualified by people halfway across the country.”

There have been only 10 new staff hired at Hazelton this year despite the desperate need with some other prison staff members having to take on the duties of corrections officers. Tarovisky says the prison needs to be able to hire applicants directly to keep officers and community members safe.

The grueling hours are taking a toll on prison staff wellbeing and many are feeling the impact at home. A Dept of Justice Office of Justice Programs report in 2020 found that the suicide rate of corrections officers is seven times higher than the national average.

From the “You Think Things Are Bad Now” department: ABC News reports that all 34,537 BOP employees would still have to go to work if the government closes for lack of funding on Sunday, leaving them without a paycheck during the period of the shutdown.

“A shutdown is absolutely devastating for our members,” Brandy Moore-White, the president of CPL-33, told ABC News. “Not only do our members put their lives on the line every single day to protect America from the individuals incarcerated, but now they’re having to go out… and figure out how they’re going to pay their bills and how they’re going to feed their families.”

All government employees are guaranteed pay during the time of the shutdown, but that money is not paid until after the shutdown ends. If you’re living paycheck to paycheck, the promise of money next week does not buy you groceries today.

WDTV, Hazelton Prison corrections officers protesting hiring practices (September 22, 2023)

ABC News, Government shutdown would be ‘devastating’ for Bureau of Prisons employees (September 27, 2023)

– Thomas L. Root

My inbox has been flooded in the last few weeks with people wondering what all will happen today, Thursday, February 1st. One said changes in the gun laws will go into effect. Another heard that the meth laws will change. Another explained that all criminal history points from prior state convictions will be dropped from Guidelines criminal history. A fourth heard that acquitted conduct will be banned for sentencing purposes.

My inbox has been flooded in the last few weeks with people wondering what all will happen today, Thursday, February 1st. One said changes in the gun laws will go into effect. Another heard that the meth laws will change. Another explained that all criminal history points from prior state convictions will be dropped from Guidelines criminal history. A fourth heard that acquitted conduct will be banned for sentencing purposes.