We post news and comment on federal criminal justice issues, focused primarily on trial and post-conviction matters, legislative initiatives, and sentencing issues.

THE COURT HAS HEARD THAT GOVERNMENT EXCUSE ON LOSS CALCULATIONS BEFORE

For the countless federal criminal defendants whose sentence is driven by a calculation of the amount of loss their offense caused, the excuse of “close enough for government excuse” has special meaning: all too often, the Government gins up some number – often enough, a WAG – and tells the Court that the precise loss figure cannot be calculated, but here’s a “reasonable estimate.”

For the countless federal criminal defendants whose sentence is driven by a calculation of the amount of loss their offense caused, the excuse of “close enough for government excuse” has special meaning: all too often, the Government gins up some number – often enough, a WAG – and tells the Court that the precise loss figure cannot be calculated, but here’s a “reasonable estimate.”

And of course, the Government reminds the court that “a district court may accept a ‘reasonable estimate’ of the loss based on the evidence presented.” And the court usually goes along with it.

The loss amount is crucial to the defendant, not only because the he or she is going to be ordered to pay that amount in restitution, but because the Guidelines offense level under USSG § 2B1.1(b)(1) – and the suggested sentencing range – skyrockets with the amount of estimated loss.

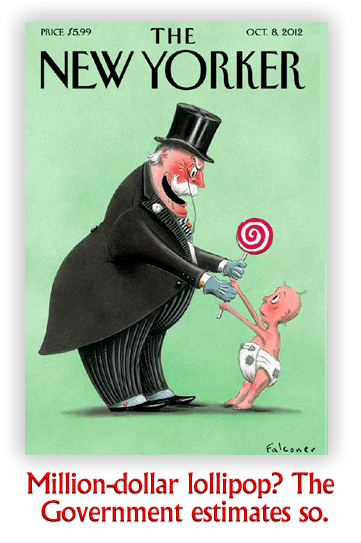

That “reasonable estimate” standard has slid over the years to seemingly permit the government to give a “reasonable estimate” (usually heavy in favor of the government) in virtually any case. Steal candy from a baby? The Government will tell the court that all it can do is estimate that the Tootsie Pop was worth $200,000.

Last week, the 11th Circuit pushed back.

Roberta Sheffield was convicted of running an IRS tax scheme that netted unjustified $1,000 tax refunds to a lot of people. At sentencing, the government produced a spreadsheet showing a loss of $3.46 million. Roberta complained that the spreadsheet contained duplicate entries, but she had no list of what entries were wrong. The government admitted there might be some errors, but argued that the burden was on the defendant to prove the spreadsheet wrong.

The 11th Circuit disagreed. It held that “once the government acknowledged that there was in fact some duplication, it could not carry its burden without correcting the spreadsheet.” The Circuit noted that recent studies show 90% of restitution is uncollectible, and that it was unlikely Roberta and her co-conspirators would ever satisfy the award.

At oral argument, Roberta asserted that the duplicate entries totaled $136,000. The Court noted that the error amounted “to a mere 4% of the government’s proposed total of $3,461,638. So one may wonder why it is that we are reversing a multi-million dollar restitution order when the result on remand is likely to be approximately the same and payment (at least full payment) is unlikely. The reason is a simple one. Ms. Sheffield has the right not to be sentenced on the basis of inaccurate or unreliable information, and is not required to pay restitution she is not responsible for.”

At oral argument, Roberta asserted that the duplicate entries totaled $136,000. The Court noted that the error amounted “to a mere 4% of the government’s proposed total of $3,461,638. So one may wonder why it is that we are reversing a multi-million dollar restitution order when the result on remand is likely to be approximately the same and payment (at least full payment) is unlikely. The reason is a simple one. Ms. Sheffield has the right not to be sentenced on the basis of inaccurate or unreliable information, and is not required to pay restitution she is not responsible for.”

United States v. Sheffield, 2019 U.S. App. LEXIS 29502 (11th Cir. Oct. 1, 2019)

– Thomas L. Root