We post news and comment on federal criminal justice issues, focused primarily on trial and post-conviction matters, legislative initiatives, and sentencing issues.

COLETTE PETERS’ TESTIMONY IS KUMBAYA MOMENT FOR JUDICIARY COMMITTEE

With the notable exception of bomb-throwing, inmate-hating Sen Tom Cotton (R-AR), the Senate Judiciary Committee treated newly-frocked Bureau of Prisons director Colette Peters with kid gloves at last Thursday’s BOP oversight hearing.

The Associated Press gushed, “Colette Peters’ testimony before the Senate Judiciary Committee — the first time she’s appeared before Congress — was a stark departure from the combative nature of her predecessor [Michael Carvajal], who drew bipartisan rebukes for foisting blame on others and refusing to accept responsibility for the agency’s problems.”

The Associated Press gushed, “Colette Peters’ testimony before the Senate Judiciary Committee — the first time she’s appeared before Congress — was a stark departure from the combative nature of her predecessor [Michael Carvajal], who drew bipartisan rebukes for foisting blame on others and refusing to accept responsibility for the agency’s problems.”

My take was the pretty much the same. Although Peters sounded bureaucratic at times (befitting her position, no doubt), her grasp of the issues, quick wit, and cogent responses made listening to her a vast improvement over Carvajal’s painful, fingernails-on-the-chalkboard testimony.

Peters continued her good run after the session ended. She told AP on her way out that inmates “in our care have the right to feel safe when they are incarcerated with us. “So we’re going to do everything we can to ensure their safety.”

Of course, Peters does not call them “inmates.” Instead, they’re “adults in custody,” an expression she brought to Washington from her position as head of the Oregon Dept. of Corrections.

Earlier, Peters told the Committee she wants people to come out of prison better than they went in, reprising her observation from her swearing-in two months ago: “Our job is to make good neighbors, not good inmates.”

While the Director’s testimony did not plow a lot of new ground, it did include several nuggets of information, a few promises that may set a baseline for any subsequent measure of her success, and – jarringly – at least one statement at odds with reality.

These are some of the highlights:

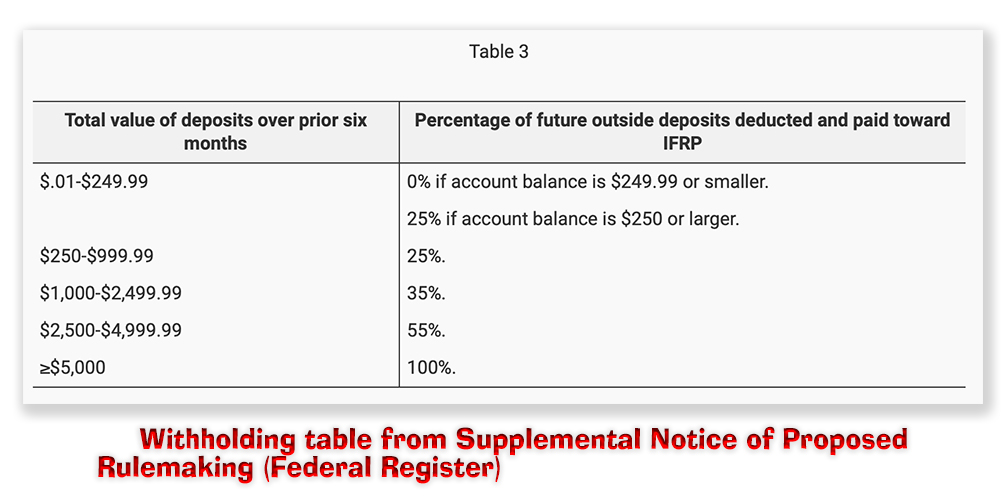

• Taking Inmate Money: Look for new Inmate Financial Responsibility Program rules being adopted by DOJ in the coming weeks. Those rules, which govern how much money can be taken from inmate phone and commissary accounts to satisfy court-imposed obligations, are currently modest. But in the wake of revelations by the Washington Post and others about large balances in inmate accounts, and recent kerfuffles about Larry Nassar (the Olympic gymnast doctor) and singer R. Kelly not paying victim restitution from their large inmate balances, the new rules will focus on “allow[ing] collection of a set percentage of all incoming funds from participating inmates” toward restitution, fines and other obligations.

Peters told the Committee that “a proposed regulation is currently under review right now with the Dept of Justice” addressing the FRP program, resulting from recent press reports about several high-profile inmates who owe restitution of sexual-abuse offenses but – despite substantial inmate accounts – were not paying.

• CARES Act: Rules on inmates returning to prisons from CARES Act home confinement are due soon. Last winter, after DOJ’s Office of Legal Affairs reversed a Trump-era holding that all CARES Act inmates would have to return to prison after the pandemic ended, DOJ announced that not everyone would get to stay home, either. DOJ promised a rule defining who among CARES Act inmates would have to come back.

In answer to questions from Sen. Cotton – who alleged in the face of all available evidence that CARES Act murderers and rapists were running amok through America’s neighborhoods – Peters noted that as the BOP “pivot[ed] out of the pandemic and really focus[ed] on kind of a future state as it relates to the pandemic, we do have that rule under review that will give the Bureau guidance on those individuals that were released on home care confinement. We’re hoping to see what that rule looks like here in the coming weeks…”

In answer to questions from Sen. Cotton – who alleged in the face of all available evidence that CARES Act murderers and rapists were running amok through America’s neighborhoods – Peters noted that as the BOP “pivot[ed] out of the pandemic and really focus[ed] on kind of a future state as it relates to the pandemic, we do have that rule under review that will give the Bureau guidance on those individuals that were released on home care confinement. We’re hoping to see what that rule looks like here in the coming weeks…”

The undisputed stats on CARES Act are that only 17 new crimes have been committed by over 11,000 home confinees. Peters characterized the results of the home confinement program, as “positive.”

Given that Peters noted in her written testimony that the BOP is receiving between 1,200 and 1,500 new inmates weekly, it is likely that use of the CARES Act to place people in home confinement – despite Sen Cotton’s fact-free histrionics – will continue.

In fact, in his opening statement, Durbin criticized the BOP for “continuing to resist petitions for compassionate release. Complaining that “our federal prison system has failed to fulfill its fundamental purpose,” Durbin urged members of Congress to visit a federal prison to “understand the stakes of these issues.”

• Abuse of Female Inmates: In light of recent sexual abuse at female facilities, Peters said in her written testimony that “members of the Bureau’s Women & Special Populations Branch are visiting all female institutions to assess the culture. They are reviewing ways to encourage a culture of communication between employees and incarcerated women. They are also reviewing gender-responsiveness practices, the quality of services provided to women in Bureau custody, and they are making recommendations to bolster services where necessary.”

In her first two months on the job, Peters has hired 40 additional internal affairs staff.

Responding to Sen Charles Grassley (R-IA)’s about her support for the rights of BOP whistleblowers to provide information to Congress free of retaliation, Peters said, “We have to create an environment where people feel comfortable coming forward, both the adults in our custody and our employees, and not only feel comfortable coming forward as employees but truly understand their obligation to come forward… provide training to our employees to ensure that they understand… that under my watch… retaliation both to our employees or those in our custody will not be tolerated.”

Responding to Sen Charles Grassley (R-IA)’s about her support for the rights of BOP whistleblowers to provide information to Congress free of retaliation, Peters said, “We have to create an environment where people feel comfortable coming forward, both the adults in our custody and our employees, and not only feel comfortable coming forward as employees but truly understand their obligation to come forward… provide training to our employees to ensure that they understand… that under my watch… retaliation both to our employees or those in our custody will not be tolerated.”

That’s good news, if it is really the BOP policy and if Peters can impose it on her 36,000 employees. But just last week, Oakland TV station KTVU, which has extensively covered the FCI Dublin sex abuse cases, reported, “Over the course of eight months, KTVU has communicated with nearly 40 women, all of whom have suffered sexual abuse at the prison, witnessed the abuse, and then were sent to solitary confinement or sent away to another prison after speaking up.”

It would seem that stopping retaliation against inmates reporting misconduct has a long way to go.

• Earned-Time Credits: The First Step Act included a program that would permit inmates to earn credits for completing programs proven to reduce recidivism.

Peters told the Committee in her written testimony that the BOP now “offers more than 85 structured Evidence Based Recidivism Reducing (EBRR) programs, along with a wide range of Productive Activities (PA). Currently, there are more than 87,000 adults in custody enrolled in structured EBRR Programs and PAs. Since January 2020, the Bureau has seen more than 227,000 FSA structured program completions, and the number of individuals who are engaging in any FSA activity has increased significantly just this year.”

She said, “the Bureau prioritizes full implementation of the FSA… and on August 31, 2022, we implemented an Auto-Calculation Application for FSA time credits. The automated calculation updates time credits monthly for all those who are eligible. Unit Teams will advise adults in custody during their regularly-scheduled Program Review meetings of their current ‘time credits’ balance, along with their updated PATTERN risk level.”

Really? Not that many inmate readers of the LISA Newsletter can tell. Although no one on the Committee questioned Peters’ representation, two days after the hearing, Walter Pavlo, writing in Forbes magazine, suggested the BOP auto-calc emperor had no clothes.

“These statements are not true,” Pavlo wrote, “and do not reflect the current situation where thousands of prisoners, some who could be released today, languish in prison waiting on a computer computation of their sentence. He said the BOP “has struggled to fully implement the [earned-time credit] program. Nearly four years since becoming law, the BOP has yet to develop an automated computer program to count the programming of prisoners and then apply those as credits against the sentence.”

“These statements are not true,” Pavlo wrote, “and do not reflect the current situation where thousands of prisoners, some who could be released today, languish in prison waiting on a computer computation of their sentence. He said the BOP “has struggled to fully implement the [earned-time credit] program. Nearly four years since becoming law, the BOP has yet to develop an automated computer program to count the programming of prisoners and then apply those as credits against the sentence.”

• Medication Assisted Treatment: Peters reported that the enrollment in the BOP’s Medication Assisted Treatment program – which combines drug rehabilitation therapy with medication that lessens the physical symptoms of withdrawal – has doubled to about 920 inmates and will continue to expand.

This is good news. I am familiar with at least one case where an inmate is being denied participation in MAT because he has been caught having taken controlled substances within the prison. Not until MAT is seen as a healthcare program and not a reward for good behavior will the neediest inmates receive the treatment they need.

• You’ve Got Mail! Answer it: Finally, something even Peters acknowledged to be a cautionary tale: Sens Grassley, Cotton and Jon Ossoff (D-GA) all complained to her that various letters and requests for information they have sent to the BOP have gone unanswered, sometimes for years. This was a failing that former BOP Director Carvajal was beaten up with during his tenure. Not answering the mail from pesky Senators and Representatives may seem like a small thing to BOP management – it certainly has gone on for years – but if Peters wants the Judiciary Committee lovefest to go on, she should not let her staff anger Congress over something so easily corrected.

Carvajal was regularly lambasted for similar failings. Peters should profit from his example.

Associated Press, New federal prisons chief vows to fix troubles, regain trust (September 29, 2022)

Bureau of Prisons, Statement of Colette S. Peters Director, Federal Bureau of Prisons Before the Committee on the Judiciary United States Senate September 29, 2022

Senate Judiciary Committee, Oversight Hearing on Bureau of Prisons (September 29, 2022)

KTVU, Federal prison director conducts ‘cultural assessment’ of FCI Dublin (September 29, 2022)

Forbes, First Appearance by Bureau of Prisons Director Falls Shorts on Facts (October 1, 2022)

– Thomas L. Root

two years ago, when the Federal Bureau of Prisons issued a Notice of Proposed Rulemaking in response to the 20 inmates out of 150,000 plus who had big money in their commissary accounts? Of course you do, because you’ve read all 1,701 of the LISA Foundation’s posts.

two years ago, when the Federal Bureau of Prisons issued a Notice of Proposed Rulemaking in response to the 20 inmates out of 150,000 plus who had big money in their commissary accounts? Of course you do, because you’ve read all 1,701 of the LISA Foundation’s posts. Of course, an inmate may refuse to participate in the IFRP program, but doing so today denies an inmate anything more than about $5.00 a month pay for work, a severely limited commissary list from which to buy food and consumer goods, no RDAP “year off” credit, and no halfway house or home confinement (among other restrictions).

Of course, an inmate may refuse to participate in the IFRP program, but doing so today denies an inmate anything more than about $5.00 a month pay for work, a severely limited commissary list from which to buy food and consumer goods, no RDAP “year off” credit, and no halfway house or home confinement (among other restrictions). The public may comment on the proposed rule by letter or electronic comments by February 18, 2025, through the regulations.gov website or by mail to:

The public may comment on the proposed rule by letter or electronic comments by February 18, 2025, through the regulations.gov website or by mail to: