We post news and comment on federal criminal justice issues, focused primarily on trial and post-conviction matters, legislative initiatives, and sentencing issues.

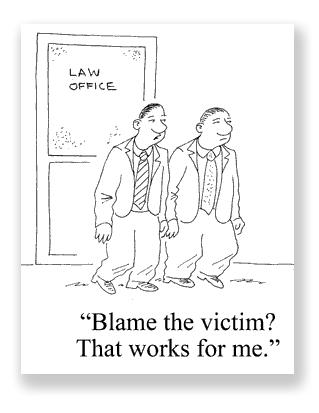

YOU CAN’T RAPE THE WILLING

Thirty years ago, when life was courser and the P.C. police weren’t roaming around being outraged about everything, an old wag of an attorney described to us his approach to an upcoming rape trial (where he represented the defendant).

“You can’t rape the willing,” he said, a line he later used in the trial to introduce the jury to his argument that the victim had been a willing participant in the offense.

Sadly for the defendant, the trial was in a small, rural Midwest county, and both the perp and the victim were male. Back in the day, the stalwart folks in rural America did not think much of gay assignations, and they were too willing to believe that the victim would have never consented to such odious conduct. In fact, the victim was quite drunk and undoubtedly nearly as willing as the defendant, at least until he sobered up hours later, but no matter. The defendant was convicted, and probably would have been whether it was consensual or not.

Sadly for the defendant, the trial was in a small, rural Midwest county, and both the perp and the victim were male. Back in the day, the stalwart folks in rural America did not think much of gay assignations, and they were too willing to believe that the victim would have never consented to such odious conduct. In fact, the victim was quite drunk and undoubtedly nearly as willing as the defendant, at least until he sobered up hours later, but no matter. The defendant was convicted, and probably would have been whether it was consensual or not.

A lot has changed since then, those unenlightened days when people hated gays and loved their bankers. Now it’s turned on its head.

Minas Litos and his friends were busy a decade ago doing what fraudsters all were doing, writing bogus mortgage applications for people who lived under bridges, collecting the proceeds, and riding into the sunset. Minos had a portfolio of real estate to “sell.” He would give his applicants down payment money, and then lie about their assets, income and cash on hand to Bank of America. In each of the transactions, Minos and his associates walked away with the purchase price of the property they had sold minus the down payment amount, since the “down payment” they received was their own cash (which they’d surreptitiously transferred to the impecunious buyer).

Minas Litos and his friends were busy a decade ago doing what fraudsters all were doing, writing bogus mortgage applications for people who lived under bridges, collecting the proceeds, and riding into the sunset. Minos had a portfolio of real estate to “sell.” He would give his applicants down payment money, and then lie about their assets, income and cash on hand to Bank of America. In each of the transactions, Minos and his associates walked away with the purchase price of the property they had sold minus the down payment amount, since the “down payment” they received was their own cash (which they’d surreptitiously transferred to the impecunious buyer).

Minos and the others were duly convicted of fraud, and as part of their sentence, the district court awarded Bank of America $893,000 in restitution. Last Friday, the 7th Circuit reversed the restitution in a breathtaking decision that blasted BOA as a willing handmaiden in Minos’ fraud (and for that matter, in the Great Recession of 2008).

Federal law requires “mandatory restitution to victims of certain crimes,” 18 U.S.C. § 3663A (the Mandatory Victim Restitution Act of 1996), including fraud. But, the Court said, this applies only where “an offense resulting in damage to or loss or destruction of property of a victim of the offense”… and “that doesn’t seem to describe the loss suffered by Bank of America as a result of its improvident loans, especially when we consider its complicity in the loss — its reckless decision to make the loans without verifying the solvency of the would-be borrowers, despite the palpable risk involved…”

Federal law requires “mandatory restitution to victims of certain crimes,” 18 U.S.C. § 3663A (the Mandatory Victim Restitution Act of 1996), including fraud. But, the Court said, this applies only where “an offense resulting in damage to or loss or destruction of property of a victim of the offense”… and “that doesn’t seem to describe the loss suffered by Bank of America as a result of its improvident loans, especially when we consider its complicity in the loss — its reckless decision to make the loans without verifying the solvency of the would-be borrowers, despite the palpable risk involved…”

In the Circuit’s opinion, more time was spent on the victim than on the defendant:

The order of restitution is questionable because Bank of America, though not a coconspirator of the defendants, does not have clean hands. It ignored clear signs that the loans that it was financing at the behest of the defendants were phony. Despite its bright-eyed beginning as an upstart neighborhood bank for Italian-American workers, Bank of America has a long history of blunders and shady practices; it narrowly survived the Great Depression of the 1930s, nosedived in the 1980s, and lost tens of billions of dollars in the crash of 2008—including $16.65 billion in a settlement with the U.S. Justice Department over charges of mortgage fraud… And at the sentencing hearing the judge said: “I think they [the defendants and Bank of America] are equally culpable. Isn’t that a fair way to look at this? … Bank of America knew [what] was going on. They’re playing this dance and papering it. Everybody knows it is a sham because no one is assuming any risk. So what’s wrong with saying they’re of equal culpability?” Indeed; and we are puzzled that after saying this the judge awarded Bank of America restitution—and in the exact amount that the government had sought.

The Court complained that the mortgage applications Minos gave to BOA were “a joke on their face.” People claimed to own real estate that they didn’t own, claimed $10,000 a month income and millions in the bank, and came back to the trough multiple times – including one woman with a claimed monthly income of $3,400 who got 6 mortgages in a 10-day period.

But, the 7th complained, BOA did no investigating whatsoever. Indeed, the Court said, “To say the bank was merely negligent would be wrong. Recklessness is closer to the mark.” The panel said BOA didn’t care, because it knew it was going to promptly unload the loans on Fannie Mae (which wore a “kick me” sign on its corporate posterior). As the Court put it, “the bank’s failure to demand evidence of the financial sufficiency of the mortgagees constituted deliberate indifference to a palpable risk that the bank’s executives must have been aware of. The bank had every incentive to close its eyes to how phony these loan applications were, because it expected to turn around and sell the mortgages to a hapless Fannie Mae.”

But, the 7th complained, BOA did no investigating whatsoever. Indeed, the Court said, “To say the bank was merely negligent would be wrong. Recklessness is closer to the mark.” The panel said BOA didn’t care, because it knew it was going to promptly unload the loans on Fannie Mae (which wore a “kick me” sign on its corporate posterior). As the Court put it, “the bank’s failure to demand evidence of the financial sufficiency of the mortgagees constituted deliberate indifference to a palpable risk that the bank’s executives must have been aware of. The bank had every incentive to close its eyes to how phony these loan applications were, because it expected to turn around and sell the mortgages to a hapless Fannie Mae.”

So, because the victim was willing, Minos and his co-conspirators should get off scot-free? Not really. The Court said

Restitution for a reckless bank? A dubious remedy indeed—which is not to say that the defendants should be allowed to retain the $893,015. That is stolen money. We don’t understand why the district judge, given his skepticism concerning the entitlement of Bank of America to an award for its facilitating a massive fraud, did not levy on the defendants a fine of $893,015.

The case is being remanded to the district court, where the judge will undoubtedly resentence Minos and his co-defendants to zero restitution, but a fine of $893,000.

United States v. Minos, Case No. 16-1384 (7th Cir., Feb. 10, 2017)

– Thomas L. Root